The accounts payable process has been rated as one of the most time-consuming, resource- and paper-intensive activities within a business, according to a study from the Institute of Finance and Management. While ensuring the efficiency, accuracy and security of accounts payable is critical for today's enterprises, it's high-time to ditch the manual tasks for something that can better meet company goals.

Bringing automation to accounts payable is the ideal solution, offering time savings as well as a robust ROI. Let's examine all the ways your organization can put money back into its pockets with AP automation:

1) Lowering processing costs

One of the main sources of savings with AP automation comes from the ability to reduce the time it takes to process vendor payments, thereby cutting down the labor costs associated with this key activity.

"The typical cost for processing an invoice sits around $7.75 per document."

According to a study from the American Productivity and Quality Center, while the typical cost for processing an invoice sits around $7.75 per document, this cost can be more than 2.5 times more expensive for bottom-performing organizations, or those without adequate AP resources.

Automating key AP processes – including invoice approval and sending payment through a secure portal – eliminates a considerable amount of manual work, reducing the time and cost required to process each invoice.

Replacing manual tasks with automatic processes can lower the cost of invoice processing to as little as $2 per document, saving the average company more than $5 on every invoice document.

2) Reducing the chance for expensive errors

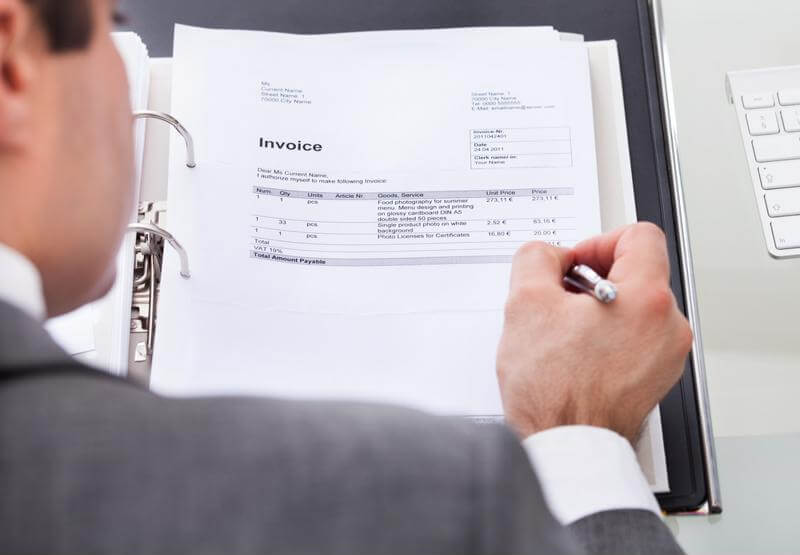

Limiting the amount of human interaction and manual processes in accounts payable with automation also means a reduction in invoice errors. These mistakes can quickly add up and become incredibly costly for the typical business, particularly if they aren't caught early on.

Research from Canon found that 3.6 percent of all invoices include errors. If an incorrect payment is sent to a vendor or partner, it can impact the entire relationship, not to mention the brand's reputation within the marketplace.

Inaccurate payments aren't the only errors to watch for, however – manual AP processes can also result in invoices being lost or misfiled. And as Canon pointed out, the more individuals involved in AP and the more times an invoice is handled, the chances of it being misfiled or misplaced only increase. Currently, it costs $125 to find a lost invoice. Worse still, if the document can't be located, it costs $225 on average to replace it.

AP automation significantly reduces these kinds of instances by ensuring that invoices follow the company's specific approval path, and that approvers receive automated emails during every step along the way. This type of visibility over AP processes is simply unmatched when tasks are carried out manually.

3) Supporting employees, vendors and partners

This one may be a bit more difficult to calculate, but it's also important to understand the savings that can come from providing better support for your internal AP team, as well as for your external partners and vendors.

Overall, 40 percent of AP professionals have reported being frustrated by paper invoices and long approval processes, and almost 100 percent of these individuals noted that AP automation provides the ideal solution.

To find out more about the savings AP automation can provide for your business, connect with the experts at SK Global Software today.

Digital and mobile payments are on the rise.

Digital and mobile payments are on the rise.

Manual accounts payable processes create security risks.

Manual accounts payable processes create security risks. Automation should be paired with human interactions for the best possible customer service.

Automation should be paired with human interactions for the best possible customer service.