The financial services sector is one of the most quickly changing industries today, particularly with the advent of new technology making it possible for both business and consumer clients to take advantage of emerging service delivery styles. From mobile to increasingly advanced and streamlined payment solutions, financial technologies – or FinTech – garners interest both in and out of the financial services industry.

In order to remain on the cutting edge, it’s important for financial services providers to know what’s on the horizon. Today, we’ll take a closer look at the FinTech trends shaking up this industry, and detail which ones will become more mainstream in the near future:

FinTech continues to disrupt the industry: Adapt or fall by the wayside

According to a report from Fujitsu, the vast majority of financial sector leaders – 95 percent – share the belief that technology represents the linchpin for forward movement in the current industry. What’s more, 86 percent feel positive about FinTech technologies and their ability to drive change within the organization.

“86% of leaders feel positive about FinTech technologies and their ability to drive change.“

Use of emerging financial technologies and strategies has considerably disrupted the historical financial services sector, to the point that the service providers clients have become familiar with in the past may be unrecognizable in the future. As the Fujitsu study found, 50 percent of industry leaders agree that within the next decade, banks as we currently know them won’t exist, and 39 percent believe bank tellers will altogether disappear within the same timeframe.

“FinTech disruptors have been finding a way in,” PwC noted. “Disruptors are fast-moving companies, often start-ups, focused on a particular innovative technology or process in everything from mobile payments to insurance. And, they have been attacking some of the most profitable elements of the financial services value chain. This has been particularly damaging to the incumbents who have historically subsidized important but less profitable service offerings.”

Organizations must update their legacy technologies with emerging FinTech solutions in a way that prepares the business for this “new normal,” tech-centered business model.

Eliminating the middleman: Sharing economy comes to financial services

The “sharing economy” – a concept most recognizable in the rise of ride-sharing and other similar services – has become a mainstay in the service industry. Consumers appreciate the ability to glean savings while still receiving quality services. And, as PwC pointed out, the sharing economy is beginning to touch financial services.

Experts predict this will have deep effects in the way clients leverage financial services, bringing more localized ownership to the sector.

“In this case, the sharing economy refers to decentralized asset ownership and using information technology to find efficient matches between providers and users of capital, rather than automatically turning to a bank as an intermediary,” PwC explained.

Emerging solutions and strategies will shake up the way clients interact with financial service providers.

Emerging solutions and strategies will shake up the way clients interact with financial service providers.Investigating blockchain

One of the most interesting developments in FinTech recently has been the continued exploration of uses cases for blockchain technology, which looks to create a digital ledger to support. While initially paired with Bitcoin and other cryptocurrency transactions, the potential uses of this technology are nearly limitless, as it can be used to create an unduplicatable record for anything of value.

Experts expect organizations to continue funding and investigating blockchain. While many initiatives and companies backing these services may not survive more than a few years, researchers don’t believe blockchain will disappear anytime soon, and will in fact become a critical part of financial services technology.

Preparing for the future

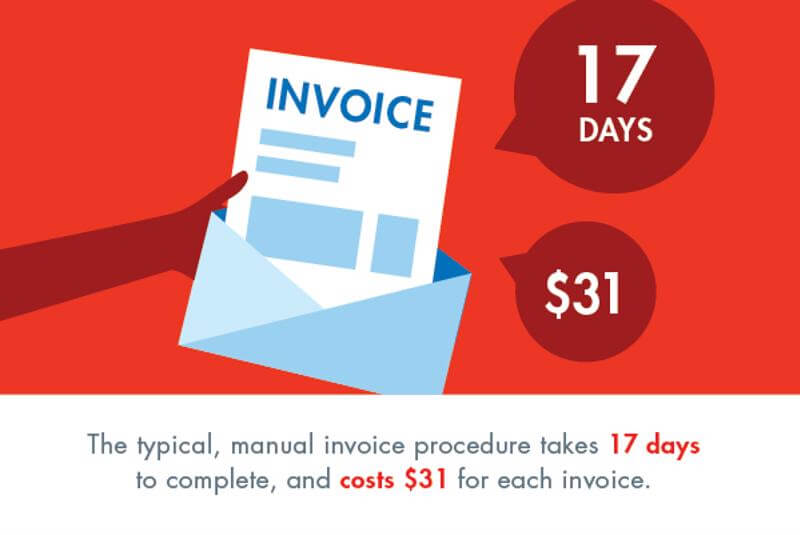

As service providers inside and outside of the financial sector prepare for new delivery styles and emerging, advanced strategies, it’s important that they have the right solutions in place to put them on the path to future success. This includes key capabilities like automation for processes like Accounts Payable, which supports time and capital savings for internal teams, providing more resources to investigate the use of innovative models and solutions.

Manual invoice processing is time consuming and expensive.

Manual invoice processing is time consuming and expensive.

An effective risk management solution is imperative.

An effective risk management solution is imperative. Processing payments in different currencies requires certain technological support.

Processing payments in different currencies requires certain technological support. Speedy ROI is just one of AR automation’s key advantages.

Speedy ROI is just one of AR automation’s key advantages.

Preparing to make the business case for AP automation? Consider including these talking points.

Preparing to make the business case for AP automation? Consider including these talking points. Automating accounts payable provides necessary transparency.

Automating accounts payable provides necessary transparency.