According to a recent study, accounting teams and C-suite executives have vastly differing opinions when it comes to their current accounts payable processes and the need for automated solutions.

The study – sponsored by SaaS firm Inspyrus and PayStream Advisors researchers – discovered that many executives are “far removed, if not out of touch” with their internal AP activity, PYMNTS reported.

This not only demonstrates the critical need for improvement in this area, but also underscores the importance of properly communicating the advantages of AP automation in a way that makes sense to decision-makers.

Fault and pain points in accounts payable

As PYMNTS noted, one researcher called the survey results “eye-opening” when describing the difference of opinion between employees who take part in AP workloads and the executives that oversee the business.

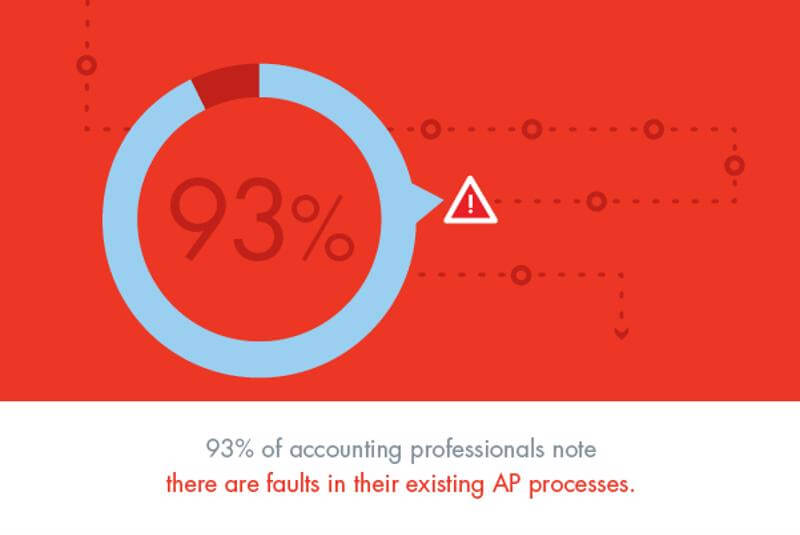

Overall, 93 percent of accounting professionals noted that there are faults in their existing AP processes, identifying manual data entry as a leading pain point contributing to these issues. At the same time, however, many executives did not agree – about half of C-suite decision-makers noted that their internal AP processes “work just fine.”

“Organizations can literally save millions through a combination of efficiency gains, cost savings and cash-back returns that come with combining invoice automation, payment automation and dynamic discounting — along with direct supplier enablement,” said Inspyrus Chief Strategy Officer Chris Preston. “However, complacency around the AP function threatens to hold organizations back from attaining these breakthrough automation efficiencies and financial returns.”

Most accounting pros say there are issues with their current AP processes

Most accounting pros say there are issues with their current AP processesHighlighting key benefits for executives

However, the problem here remains, and accounting professionals must approach efforts at gaining executive buy-in for automation carefully. After all, executives may not be aware of all the in-depth detail and work involved in the current AP automation process, and it’s imperative that the accounting team highlight the advantages that will resonate the most with the C-suite.

In this vein, Untapped recommended discussing elements like:

- The financial gains: This is particularly critical when speaking to the CFO. Underscoring advantages related to an AP automation solution’s robust return on investment, the low financial risks it presents, and how the technology will contribute to reporting accuracy and operational efficiency will help make the case here.

- The ease of use and perks for internal IT: It’s also beneficial to demonstrate how an automated solution might support the internal IT team. As Untapped pointed out, many internal IT staff are stretched thin in terms of resourcing, and executives don’t want to put more on their shoulders with the deployment of another software platform. In this way, finding a supportive AP automation vendor is key.

- Available options: Speaking of vendors, accounting teams seeking buy-in should do their research ahead of time and be ready to present different options that suit the company’s needs. Once convinced of the potential benefits, executives will want to be sure that they’re not overpaying for more features than they need, and that they’re selecting a robust and trustworthy software partner.

To find out more about making the business case for AP automation, connect with our experts at SK Global Software today.