Invoices, the approval process and other related internal payment processes can be the Achilles’ heel of enterprise financial activity. Accounts payable has long been known as one of the most resource-intensive areas of business, and since the workflow involves so many moving parts, it isn’t difficult to understand why.

However, even with advanced AP automation solutions available, some companies still choose to do things according to legacy strategies. Manual, paper-based accounts payable is on its way out, and it’s time for businesses to ensure that their financial departments have the tools to keep up.

If your organization isn’t using AP automation, you’re missing out on some serious advantages:

1) Eliminate inefficient processes

Companies that still take a manual approach to their accounts payable workflows may be supporting inefficient – not to mention time consuming – processes. This sometimes happens without decision-makers realizing it, but when stakeholders take a closer look at some of the bottlenecks that can easily occur with manual AP processing, the message is clear:

- Manual invoice and data entry takes time, and if any information is incorrect or missing, it draws the process out further.

- Reconciling payments against purchase orders and verifying invoices according to receiving reports by hand is critical, but also can also take significantly longer than necessary, delaying approval and payment.

- The approval process is laborious and paper-based strategies require stakeholders to be there in person. As a result, approval could potentially be put off by a sick day, vacation, or other out-of-office period.

«AP automation can reduce invoice processing costs by as much as 70 percent.»

When stakeholders add up all this time – and consider the ways in which these hours could be better spent – it’s clear what’s missing. Automation can ensure that invoices are entered into the system correctly, everything is reconciled and verified automatically and that the overall approval process is streamlined through online platforms even when approvers aren’t physically in the office.

2) Put money back in your wallet

In addition to missing out on significant time savings, companies that use paper and manual processes for AP are also spending more than they need to. We’re all familiar with the saying, «Time is money.» This very much applies to drawn-out AP activity.

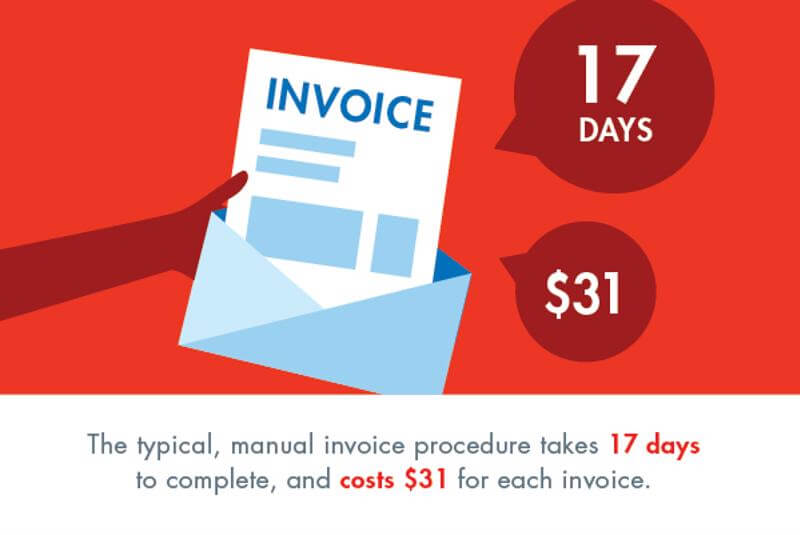

Long approval and other tedious, by-hand workflows drive up the overall costs of invoice processing. A study from Aberdeen Group found that the typical, manual invoice procedure takes 17 days to complete, and costs $31 for each invoice. This may not seem like much, but when one considers that some businesses process as many as 5,000 invoices a month, the numbers can add up quickly.

Putting AP automation in place can reduce invoice processing costs by as much as 70 percent, thanks to streamlined workflows and overall ease-of-use of advanced solutions. In this way, companies that leverage automation have more time on their hands to devote to critical processes, as well as more capital to support their key initiatives.

Manual invoice processing is time consuming and expensive.

Manual invoice processing is time consuming and expensive.3) Support end-to-end security

Finally, there’s the question of security, which businesses simply cannot afford to overlook. Manual processes can create several instances for financial risk and even fraud:

- Fifty-seven percent of business leaders noted that paper checks were the type of payment most vulnerable to fraud, according to a study from the Association for Financial Professionals.

- Manual processes make it difficult for employers to glean the type of in-depth visibility that they require into the company’s payment processes.

- It’s much more difficult to track and verify the standards of the company’s internal approval process rules within manual, paper-based activities.

An automated solution, on the other hand, can address these security issues, ensuring that stakeholders can consistently see where in the procedure an invoice is, which have been approved, and which invoices are awaiting approval. Advanced AP automation also offers access to historical documents, and enables administrators to adjust their approval process at any time.

Best of all, a solution like this from ExFlow and SKsoft ensures that payments are sent through the most secure gateway, reaching recipients via the most protected path possible.

Is your company missing out on the advantages of AP automation? Click below to learn more!